Business Insurance in and around Traverse City

Traverse City! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Leelanau

- Suttons Bay

- Alden

- Glen Arbor

- Maple City

- Cedar

- Williamsburg

- Empire

- Grand Traverse

- Northport

- Omena

- Kingsley

- Leland

- Interlochen

- Grawn

- Buckley

- Elk Rapids

- Honor

- Lake Ann

- Lake Leelanau

- Kewadin

- Fife Lake

- Antrim

- Benzie

Help Prepare Your Business For The Unexpected.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a customer stumbling and falling on your business's property.

Traverse City! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

With options like business continuity plans, a surety or fidelity bond, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Todd Hart is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Curious to discover the specific options that may be right for you and your small business? Simply call or email State Farm agent Todd Hart today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

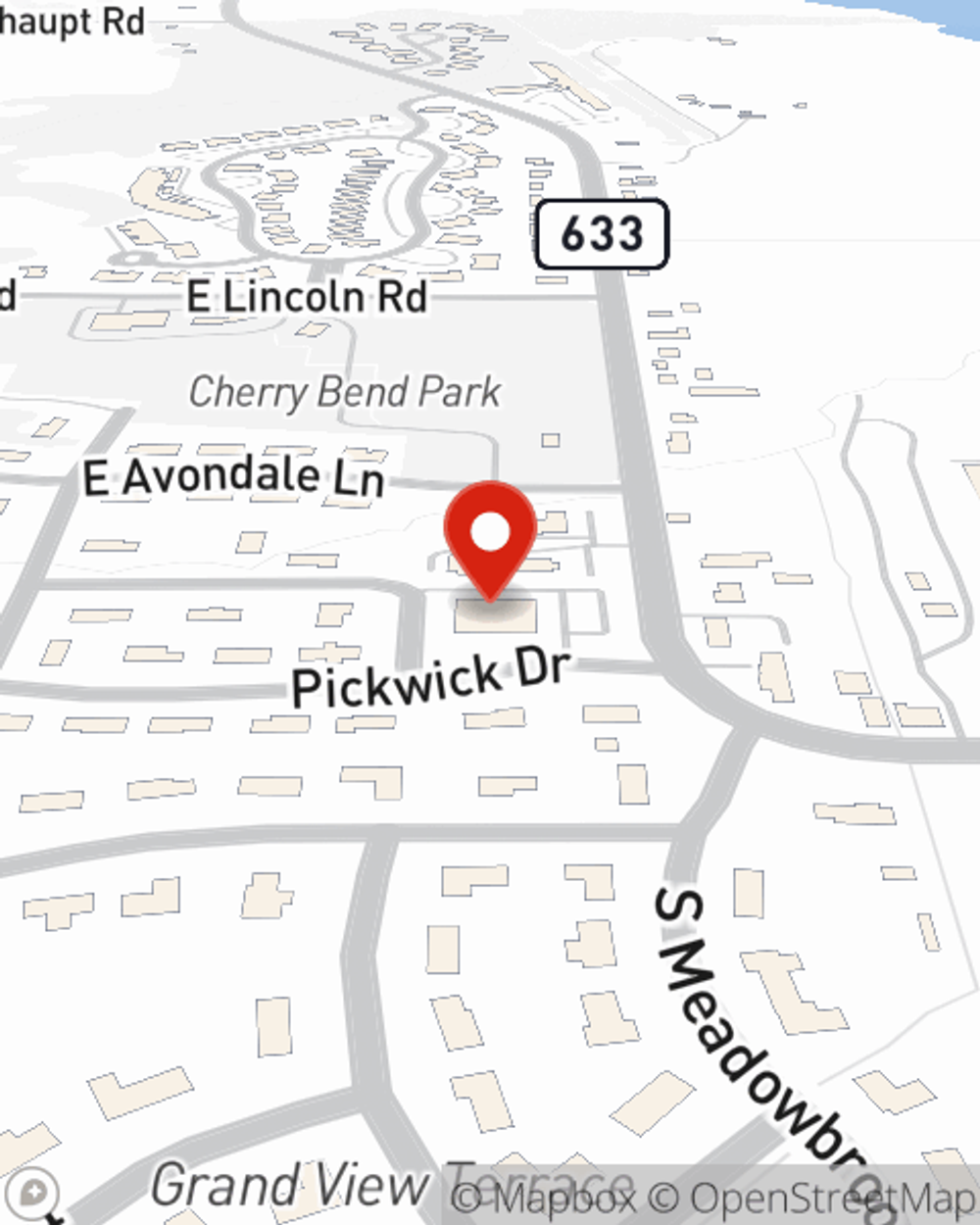

Todd Hart

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.